SBI features on the Fortune Global 500 list as one of the biggest corporations in 2020. Here SBI is the only Indian Bank that is ranked in this list. It has been the most trusted bank in India for generations with a legacy of more than 200 years. Let’s now see more about SBI financials, the SWOT analysis of SBI Bank, and many more factors in detail.

About SBI

State Bank of India is an India-based international Bank having a sturdy presence in the finance and banking landscape.

In 1955, the Bank of Madras merged with the Bank of Calcutta and the Bank of Bombay, which then turned into the brand name – State Bank of India. The bank is the merger of more than 23 banks from its 200 years of history.

In 1955 the Government of India to command over the Imperial SBI with reserve SBI while taking its 60% stake.

The company has diversified a number of businesses through its different subsidiaries like mutual funds, cards, Life insurance, general insurance, etc. The bank has a presence in 31 foreign countries with approximately 220 offices.

It is the largest Indian Bank having the 14th market share The bank has a very huge network of more than 20000 branches with 45 crore customers. SBI is a public sector bank and takes approximately 30% share of the total deposit and loan market.

SBI at a Glance

| Key People | Shri Dinesh Kumar Khara

Shri Rajesh Kumar Dubey CA Dharmendra Singh Shekhawat CA Prafulla P Chhajed Director Smt Swati Gupta. |

| Products Offered |

|

| Year of Establishment | 1 July 1955 |

| Annual Revenue (as of FY24) | US$53 billion |

| Net Income (as of FY24) | US$8.3 billion |

| Total Assets (as of FY24) | US$760 billion |

| Total Equity (as of FY24) | US$51 billion |

| Origin | State Bank Bhawan, M.C. Road, Nariman Point, Mumbai, Maharashtra, India |

| Type of Bank | Public |

| Total no. of employees | 2,32,296 |

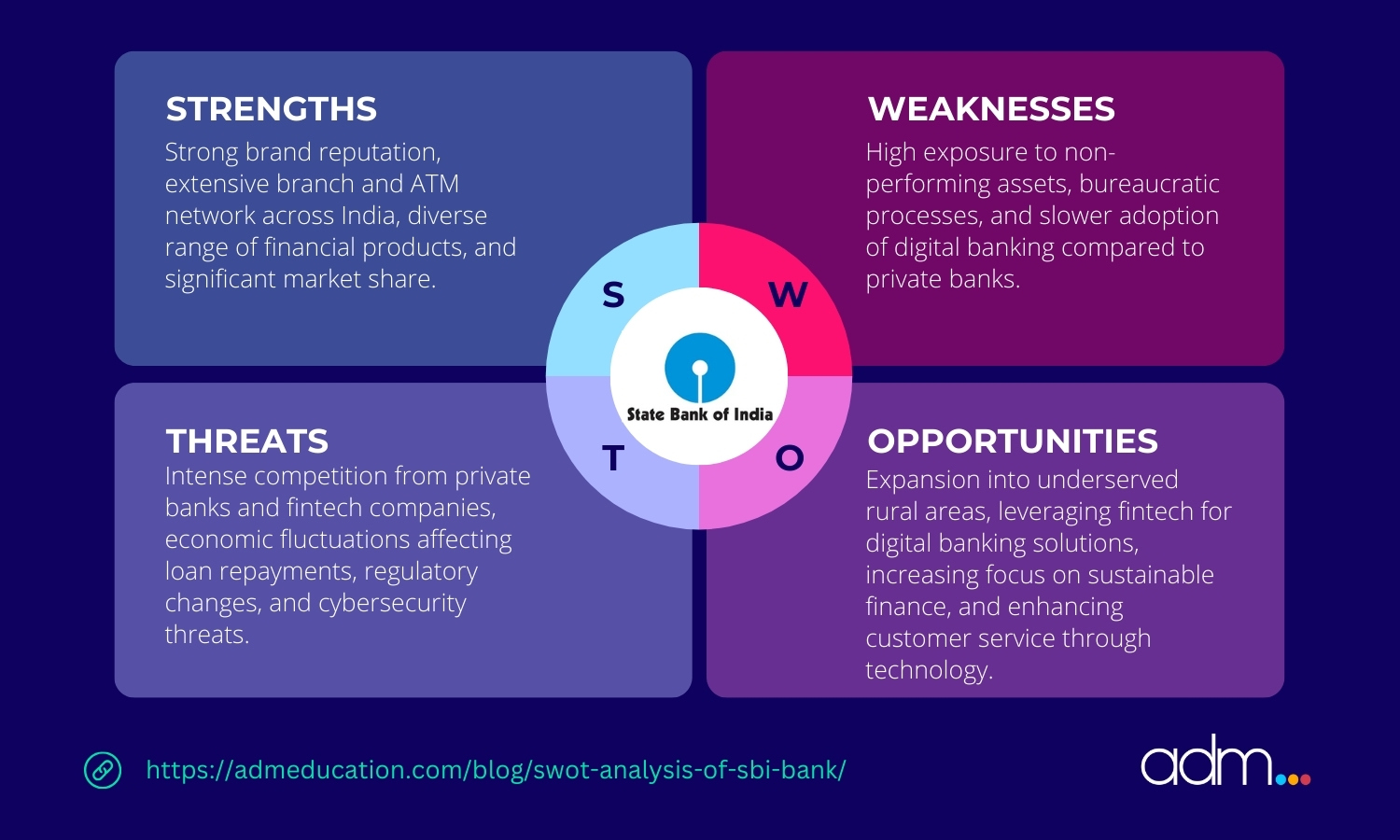

SWOT Analysis of SBI

The SWOT analysis is used to assess and identify opportunities and threats of a business, which is essential for corporate strategy and decision-making. This assists the company in its development.

Strengths of SBI

Here are the strengths of SBI in detail –

Strong Government Back

SBI is a public sector bank and has complete support of the Indian government. This is what strengthens its position as one of the most powerful banks in India. Also, the bank has a rich history of more than 200 years that has gained vast goodwill. Due to this, people have a great belief towards the excellence of it.

Increased revenue

It is a multinational company having 221st position in the Fortune Global 500 list. This indicates that the bank has a huge revenue as well as capital that makes it the strongest in itself.

Wide National and international reach

SBI has more than 20000 branches along with 60000 ATMs across India. Not least, the company is also active in 30+ countries and deals with currency trading across the globe.

Continuous Development

SBI is committed to offering consistent learning plans to its employees that keep the team ahead of the competition. Also, the bank has a broad range of operations that helps it reduce costs. This way the bank of us competitive pricing as per its competitors.

High-risk management and R&D

SBI operations involve very strong risk management strategies that protect it against major financial threats. It ensures stability amid market uncertain situations.

SBI also gives strong focus on research and development and consistently discovers the latest banking technology to remain at the age of the banking sector.

Weaknesses of SBI

The weaknesses of SBI include the following –

Employees behavioral issues

SBI is undoubtedly the pillar of the Indian banking sector but has a lot of issues with the attitude and behavioral issues of its employees. The bank has been inefficient in offering great customer satisfaction and loyalty.

Technology upfront

SBI should get more quick in integrating its technology-driven solutions. Today, customers are inclining more toward tech-savvy banking options and negligence towards this can be harmful to the company’s competitiveness.

Slow Innovation

SBI is still treated as a traditional bank. This perception of customers may deter the potential new clients that are more advanced and expect a dynamic banking experience with SBI’s established brand.

Bureaucratic power

SBI is a public center entity and navigates through different layers of bureaucracy. This results in delayed decision-making and a very slow rollout of new campaigns and initiatives. It may cause internal frustration as well made customers who are expecting fast service.

NPAs

SBI also faces challenges with non-performing assets. These bad loans disturbs the bank’s overall financial health and may affect the investor confidence as well.

Employee retention

Today private sectors and fintech firms are offering attractive offers to their employees. Here SBI requires efforts to retain the top talent in its Bank. If not done so it may deplete the intellectual capital of the company which is very crucial for its Innovation and growth.

Reliance on conventional banking process

The bank is dependent on traditional banking operations that may hold its further progress in the market. Also, the structure of the bank is very complex which may proof hazardous as per the new trends and customer demands.

Opportunities for SBI

SBI opportunities lie in these segments –

Hiring the Youth

State Bank of India should actively recruit youth to refresh its major leadership which might be a major move to move ahead with the new generation. This will future-proof the institution while also offering fresh views and ideas throughout its banking operations. It will definitely define the operation function of the bank in this sector.

Expanding rural spaces

Some areas in India’s rural landscape showcase a major growth avenue for the bank. The bank can expand services and can experience a huge base of customers over there. It will help in the social and economic upliftment of the communities in these regions which will drive stability and growth.

Foreign market penetration

The present global financial scenario gives a lot of opportunities for the State Bank of India. The bank expanded its footprint internationally which will diversify its income streams along with taking the brand recognition throughout the globe. This major move can open doors to a new loyal customer base along with market dynamics.

Utilizing cross-selling potentials

Since the bank has a number of financial products it can maximize its footprint by efficiently cross-selling services to huge customers. It can optimize revenue streams without giving the additional cost of taking new customers.

Pension & Insurance services expansion

Today the Indian demographic is shifting towards a huge base of old population that demands detailed insurance and trustworthy pension schemes. SBI has a great opportunity to capitalize on this requirement by strengthening its Financial Solutions in these spaces.

Improved NRI services

The State Bank of India can improve its services for non-resident Indians. It will help the bank gain a significant growth avenue by fulfilling the unique needs of these groups of customers.

Threats to SBI

SBI should be aware of these threats –

Emerging private banks

The banking industry landscape is consistently competitive and a number of private banks are growing in size. This is also a result of merger and acquisition activity. This trend may threaten SBI’s presence in the market.

Fluctuating policies

The Reserve Bank of India develops policies as per the banking sectors and any measure modification in these regulations and rules mis significantly affect the operations of SBI. The latest change in the statutory liquidity ratio directly affects the way SBI operates its loans and funds to the public. It usually limits the profitability and operationality of the bank.

Intense competition

Along with private and foreign banks, SBI also faces competition from other public sector banks, non-banking financial companies, and fintech companies as well. The competition has become more severe as several fin-tech startups are offering lucrative digital banking solutions that are attracting a younger demographic.

Technological disruptions

Like other industries, the banking industry is also witnessing quick technological changes that are making existing systems obsolete. The bank should consistently invest in upgrading its technology not just to improve effectiveness but also to fight the intense competition.

Cybersecurity Issues

Banking services are usually delivered online and cyber threats like fishing, data breaches, system hacking, as well as online fraud have a major risk. Since SBI has a very great customer base, the prime target for the bank is to invest huge in substantial technical upgrades that will secure its digital channels.

Economic slowdown

Recessions and economic slowdowns badly impact the banking operations affecting the profitability of the banks to a greater extent. Since SBI is usually dependent on Indian customers the economic disturbance in India may result in reduced loan demand and high default rates which will stress the financial health of the bank.

Brand image risk

Any kind of scandal or negative publicity may damage the bank’s reputation. Since the world today is connected by social media news like cyber security attacks, data breaches, or any financial scams spreads rapidly over all the channels. It will lead to loss of customer trust as well as major withdrawal deposits that may harm the stability of the bank.

Top Competitors of SBI

The top 5 competitors of SBI are listed below –

HDFC Bank: It is the largest private sector bank in India offering a wide range of financial and banking services like treasury wholesale and retail banking operations. It competes directly with SBI.

ICICI Bank: It is another major private sector bank in India that competes directly with SBI in different segments like wealth management, corporate banking, and retail banking services.

PNB: Punjab National Bank is also among the top public sector banks in India that offers a wide range of financial and banking services. It vies directly with SBI in individual and corporate customer segments.

Bank of Baroda: It is the first public sector bank providing various banking and financial services that are in competition with SBI.

Axis Bank: It is the most demanding private sector bank offering a different range of financial and banking products including international corporate and retail banking.

Conclusion

Down the line, SBI is an emergency figure in the global banking sector having its legacy of two centuries of major contribution to the country’s economic structure. Irrespective of challenges like operation and efficiency technical adaptability and the changing digital finance landscape the bank’s strength as well as opportunities lies in its Innovation and growth strategies.

The strategic initiative is focused on global expansion and digital transformation customer satisfaction services. The bank should continue its legacy as a banking giant that drives financial streams and supports the country’s journey towards improve the digital economy.

Janardan Das is a seasoned Growth Lead with over five years of experience in digital marketing. He specializes in crafting effective marketing strategies, including SWOT analysis and digital marketing courses, to help businesses thrive in the competitive landscape. He is passionate about sharing his knowledge and insights, empowering others to succeed in their marketing endeavors.