Indian banks have been playing a very significant role in enhancing the country’s GDP by approximately 3.5 trillion USD. And among them, ICICI Bank is one of the leading banks in India including approximately 20% of the Bank Nifty index. Let’s now see in detail about ICICI Bank’s financials, growth planning, SWOT analysis of ICICI Bank, and much more in this blog.

About ICICI Bank

ICICI (The Industrial Credit & Investment Corporation of India) is one of the leading multinational companies in India. The first Chairman of ICICI Ltd was Sir Arcot Ramaswamy Mudaliar and the bank was incepted in January 1994.

The bank offers several services in the banking and final sector for retail customers as well as corporate employees. The bank also possesses different delivery channels as well as specialized subsidiaries to fulfill its customer demands.

Products offered by ICICI Bank

- Consumer banking

- Commercial banking

- Insurance

- Credit cards

- Investment banking

- Private Equity

- Mortgage loans

- Mutual funds

- Private banking

- Wealth management

& etc.

ICICI Bank at a Glance

| Key Persons | Girish Chandra Chaturvedi – Chairman

Sandeep Bakhshi – MD & CEO |

| Year of Establishment | 5 January 1994 |

| Annual Revenue (as of FY24) | US$28 billion |

| Net Profit (as of FY24) | US$5.3 billion |

| Corporate Origin | Mumbai, Maharashtra, India |

| Type of Company | Public |

| Total no. of employees | 130,542 |

| Total assets (as of FY24) | US$280 billion |

Detailed SWOT Analysis of ICICI Bank

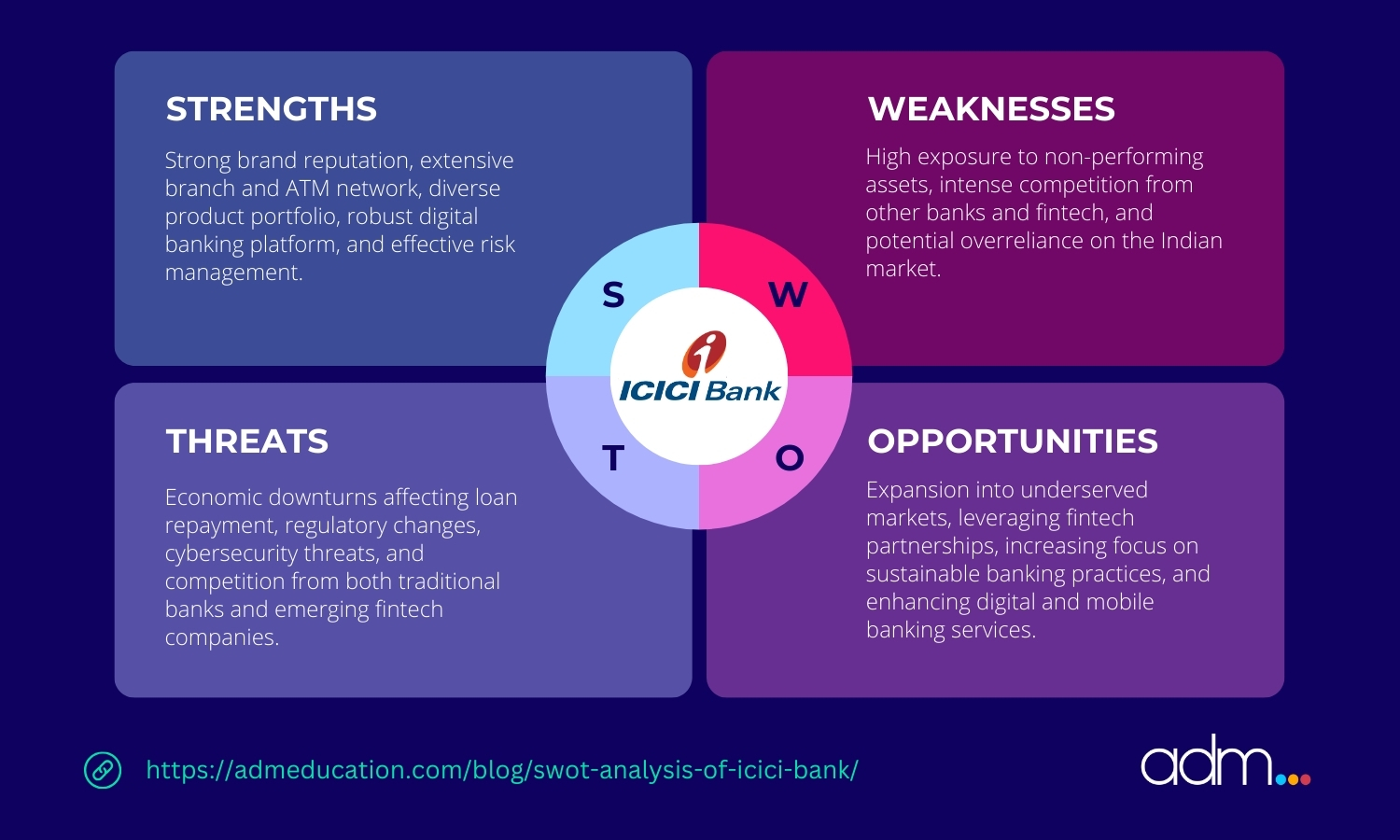

Let us now explore the SWOT analysis of the bank. It is a helpful tool that assists companies in rectifying their weaknesses, strong points, and many more factors to focus on.

Strengths of ICICI Bank

Strengths are those areas that make a company successful in the long run.

Global network

Recently in 2023, the ICICI Bank added approximately 500 new branches to its network. Previously, it had approximately 6000 branches and 15000 ATM machines. This indicates the bank’s worldwide reach with its outstanding marketing strategies. It offers the company an opportunity to serve a global base and offer seamless financial services with great convenience and connectivity.

Tech-adoption

The bank has been constantly leveraging the latest technology and investing heavily in them. It makes use of the technology is offer a number of transaction options for customers. These transaction alternatives include net banking, mobile banking, NRI services, etc to make banking operations more user-friendly and easily accessible.

Highly profitable margins

The banking industry is quite competitive and hence ICICI Bank exceeds its profitability as per regional bank measures. ICICI Banks’ capability to adapt to market changes as well as operational efficiency assists in the training of advanced profit margins.

In the first quarter of 2024, the core operating profit of ICICI Bank grew to US$ 1.7 billion at 35.2%.

Different revenue models

The bank has been consistently diversifying and its financial services succeed in the competitive market. It has also met specifications in its revenue platform to minimize its reliance on the financial space.

Innovative marketing campaigns

ICICI banks dynamic marketing strategies to enhance the brand exposure. The bank is an expert in innovative marketing including celebrated endorsements, valuable sponsorships, and much more that has helped the bank attract potential customers.

Awards and accolades

The company has been endorsed with numerous honors for its social responsibility and excellent performance.

Some of the awards include –

- Best Company to Work for in India – Business Today

- Bank of The Year – Business Today

Greater customer satisfaction

The company gets the best-in-class customer satisfaction with its excellent CRM department. Emphasizes customer relationships leading to strong brand equity as well as unwavering trust among the existing customers.

Weaknesses of ICICI Bank

Below are the weaknesses of ICICI Bank.

Money laundry Case

ICICI Bank faced the largest banking scam involving money laundering over a decade ago. This specific change provoked the Reserve Bank of India and the Indian government leading to the suspension of 15-20 head bank executives. This case tarnished the image of the bank in the market as well as hamper the business integrity.

Reliance on the Indian market

Respective of the global reach the company has a huge dependency on the Indian market. This makes the bank more valuable to the economic downtime and creates hazards to the bank’s financial growth and stability.

NPAs

Every Bank industry beer has nonperforming assets or you can say it bad loans. So ICICI Bank has that. Having higher nonperforming assets can affect the profitability of the bank as well as its balance sheet. In Quarter 1 – 2024, the bank has shown NPA’s of approximately US$150-200 million.

Lack of investment in customer services

To stay competitive, today ICICI Bank should invest more in research and development departments, especially in customer service applications. It can enhance the reliability of customers.

Opportunities for ICICI

Opportunities are those areas where the company needs to be vigilant and focused for successful growth in the future.

Focusing on the young generation

Today, young customers are more dependent on mobile devices as well as net banking which offers a great opportunity for the bank. It also attracts technically advanced customers and can improve itself through online banking services.

Improvement in rural areas

Irrespective of its expensive network ICICI Bank lakh financial services in rural Indian network. In this area, it can meet the market needs and can enhance its customer base by opening its branches in the required locations.

Economic evolution

The US economy is rising faster than expected which allows the bank to get great profits from these regions.

Higher customers in lower sections

Customers are shifting from unlicensed operators to regulated financial firms. This gives the bank a greater chance to hit the entry-level market with its awesome services.

Necessary banking services over there can appeal to customer areas that may boost inclusion and growth.

Tech- advancements

Rapid technical improvements transform the banking businesses while offering new services and productive levels as well. Constant innovation helps ICICI Bank new services and products to the market while strengthening its market share to a greater extent.

Government regulations

If a regional bank is disorganized then it may be a threat from the regulatory environment. This scenario helps ICICI to appeal to dissatisfied customers from non-compliant banks. This way the bank can augment its customer.

Threats to ICICI Bank

Below are the risks that the bank is required to mitigate.

Intense competition

The financial business face is constantly changing due to product development cycles and has contributed hugely to increasing the competition.

ICICI Bank has a very large customer base that requires adapting to flexible as well as smaller strategies to fulfill the customer requirements. In the long run; the bank intends to stay in the competitive market, so it has to adopt a more flexible approach to tackling these threats.

Political environment

Issues like global instability make ICICI bank functions reliable and unstable. It can hamper the company’s foreign market planning as well as local marketing strategies.

Lack of skilled workforce

With the enhanced employee turnover and growing requirement for new solutions constantly ICICI Bank lacks a shortage of skilled workforce. Due to this lack, the bank may face competitively and operate with low performance.

Fluctuating demographics

ICICI Bank faces a major threat from the young generation’s financial habits. However, things are also changing in the senior citizens’ spending habits. This may cause pressure margins on the bank.

Privacy concerns

Today online transactions and net banking are more convenient and widely used across the globe. This gives rise to cyber attacks as well as privacy data breaches. Hence, ICICI Bank should invest heavily in digital platform security to retain its customer loyalty, trust, and integrity.

Top Competitors of ICICI Bank

Here are the top 5 competitors of ICICI Bank.

- HDFC Bank: It’s the largest private bank in India and offers a myriad of financial services like wholesale banking, retail banking, etc.

- SBI: SBI is one of the biggest giants in the banking sector. It competed directly with ICICI in various financial services.

- Axis Bank: This giant bank offers a range of financial services like international banking, corporate banking, etc.

- Punjab National Bank: PNB also competes directly with ICICI while offering services like personal banking, international banking, etc.

- Kotak Mahindra: The bank’s broad range of financial products including loans, credit card, etc.

Conclusion

ICICI Bank has a very innovative history as well as a global footprint that makes it the best financial service provider in the banking industry. Technical advancements, market leadership, as well as, different income sources have made the bank and ultimate choice. However, weaknesses like higher NPAs and regulatory issues may require quick attention.